Attend Your Reach School

October 30, 2017

Is the New Tax Act a Gift to Parents?

January 9, 2018Get a Second Opinion on College Funding Advice

Just after Halloween, I attended a college planning session at a local high school that was put on by two experienced college planning professionals. While the first hour of their presentation was informative, toward the end of the session, misstatements and exaggerations were made and pressure tactics employed to motivate the attendees to act right then and there. As with any big financial decision, parents should get a second opinion on the financial advice they are given by so-called college “experts,” and they should be sure they are getting their advice from a fiduciary who has their back.

Few financial professionals have a fiduciary duty, which means that they must always act in the best interests of their clients. CPAs and CFP®s have this duty. Most financial advisors and planners and insurance salesmen without those certifications are held to a lesser standard. Based on a review of the presenter’s credentials, neither of these college funding “experts” had a fiduciary duty.

About an hour into the session, I was surprised when one of the presenters (who owns an insurance agency) made the claim that using 529 account funds to pay for college requires you to report the proceeds as income on your financial aid forms. This income would effectively lower the amount of any needs-based aid. The presenter’s statement was, at a minimum, highly misleading. The fact is that parents who pay their child’s qualified educational expenses from a 529 account that they funded do not trigger any income, as long as the withdrawals don’t exceed qualified educational expenses. Some 529 withdrawals do trigger income, such as when money from a grandparent’s 529 account is used to pay educational expenses. But this is not the norm, as Fidelity notes that only 15% of its 529 accounts are held by grandparents. For the presenter to make the general statement that using 529 proceeds to pay for college triggers income is disingenuous and absurd.

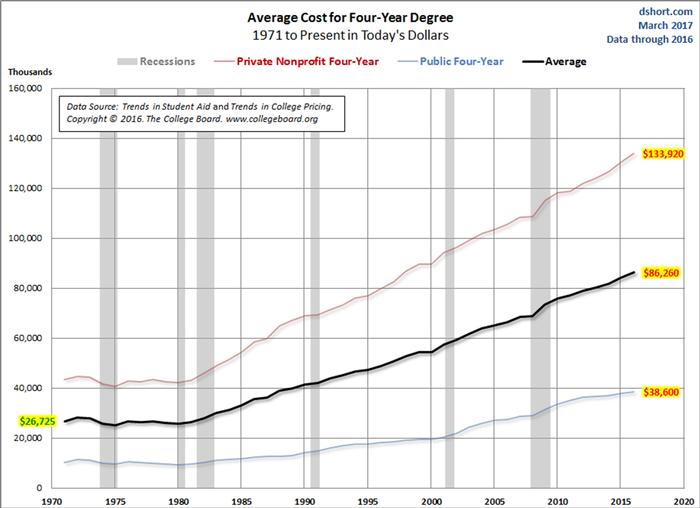

The second college planner then presented a frightful hypothetical example of parents incurring $40,000 of parent student loan debt in each year their children were in college. In his example, incurring $40,000 per year per child for multiple children—plus the compounding interest—left the parents with over $1 million of debt and huge monthly payments in retirement. While I agree that parents today are taking on excessive student loan debt on behalf of their children, this gentleman grossly exaggerated the problem, and failed to disclose that the average student loan debt of parents over age 50 is $37,000, not $1,000,000.

Then came the pitch. If you signed up for a meeting right then and there, they would waive the $250 “audit” fee. Rubbish. Don’t fall for these pressure tactics. Instead, look for a CPA or CFP®with college funding expertise. And if you can’t find a fiduciary with college funding experience, then at the very least get a second opinion to verify what the first college planner has told you. Otherwise, you may wind up with buyer’s remorse and that sinking feeling that the college funding “expert” just took you for a ride.